More and more we’re getting nannies asking about how to get health insurance built into their compensation packages; we’re realizing many more employers asking how they can help with nanny health insurance benefits, too. That’s fantastic! Just knowing how to go about doing it is where things get confusing. Let’s consider the question: what’s a good option for nanny health insurance coverage? In this post, we’ll lay out the landscape as we understand it and how we go about consulting clients on healthcare for their employees.

A Quick Background on Nanny Health Insurance Benefits

Clients and their household employees are generally looking for tax-favored health care options. Currently there are two solid options available, the Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) and the Individual Coverage Health Reimbursement Arrangement (ICHRA). Both are tailored for small employers not offering group health insurance, and support employees obtaining coverage on their state health insurance exchanges.

So Which Option is Better for My Nanny and Our Family?

There are many similarities and some significant differences between the two options. In general, we find the QSEHRA the most flexible option for families who intend to provide modest support (not to exceed $529.16/mo for a single employee, $1,066.66/mo for an employee with a family plan). Important to note, if you change jobs, don’t currently have insurance, and you negotiate a QSEHRA benefit with your new employer, this is a “qualifying event” and you have 60 days to do a special health insurance enrollment. Employers who wish to provide more comprehensive health insurance reimbursement will look into the ICHRA. However, an important caveat is that the ICHRA will not apply to the household employee who is covered by their spouse’s employer’s group health insurance. This article compares the QSEHRA and ICHRA in more detail.

So How Does Nanny Health Coverage Work?

Both options are tax advantaged health reimbursement plans. This means monies the employer contributes are not subject to employer taxes (about 10% of the contribution) and are also not subject to employee taxes (15% or more, depending on the employee’s circumstances).

Both options require the employer to set up “plan documents” defining the plan. This is not as complicated as it sounds, and there are links below to sample plan documents. Completely outsourced solutions are available economically from our partner at Take Command Health.

Because these are reimbursement plans, the employee first pays for the allowed expense (insurance premium, co-pays, prescriptions, dental and vision and more) and then submits the receipt to the employer or 3rd party administrator for reimbursement.

Perhaps most importantly, when an employee is covered by either of these tax advantaged health reimbursement plans, the employee must indicate on their account on the state’s health insurance exchange they are receiving support (and how much) from their employer for their healthcare.

Details and Restrictions of Nanny Health Insurance Benefits

The IRS allows an employer to use the QSEHRA to reimburse healthcare costs to their employees tax-free up to annual limits. In 2024, those limits are $6,350 for a single plan and $12,800 for a family plan; these limits are prorated to monthly equivalents. The ICHRA does not have any annual limits.

Each employee will need to have an ACA compliant plan (any plan that meets “minimum essential coverage,” basically a plan purchased through healthcare.gov) and the reimbursement is valid for any qualified healthcare expense – premiums, co-pays, prescriptions, etc. Any QSEHRA reimbursement given over the annual or monthly limit will count as taxable wages for both the employer and employee.

Lastly, in order for these reimbursements to remain tax-free they must be reported on the employee’s Form W-2. The purpose of this is because an employer’s reimbursement will reduce or remove the subsidy the employee might receive from the government. An employee cannot legally have a full government subsidy and a reimbursement from their employer.

QSEHRA and ICHRA Logistics for Nanny Health Insurance Benefits

A QSEHRA or ICHRA is designed to have an employee purchase their own insurance plan from the marketplace, and then be reimbursed by their employer for the expenses. After a qualifying expense, an employee would submit a reimbursement form (included in the sample templates linked below) to their employer, and then receive the funds, likely with their next paycheck. Whether this reimbursement is straight from an employer or through a payroll service like ours doesn’t matter, the important thing is that it gets recorded properly. At the end of the year, all reimbursements realized are reported on the employee’s Form W-2.

Employers can use health reimbursement plans as a benefit to help sweeten their offer. Employers find these plans attractive not simply for their tax advantages, but also because they allow them to cap their annual health subsidy for their employee, avoiding the risk of premium increases year over year. They can offer it in addition to the wage they were already planning on, or potentially save some taxes on both sides by shifting some taxable wage to the health reimbursement plan instead. Many families implement these health reimbursement plans in lieu of a raise.

You can Outsource QSEHRA and ICHRA Administration

Those looking for a comprehensive solution to QSEHRA administration should consider enrolling with our partners at Take Command Health. Their QSEHRA Guide and ICHRA Guide have detailed answers to all your HRA related questions. Even better, if you enroll with promo code HOMEWORK30, you’ll receive 30% off standard pricing.

QSEHRA Tax Savings

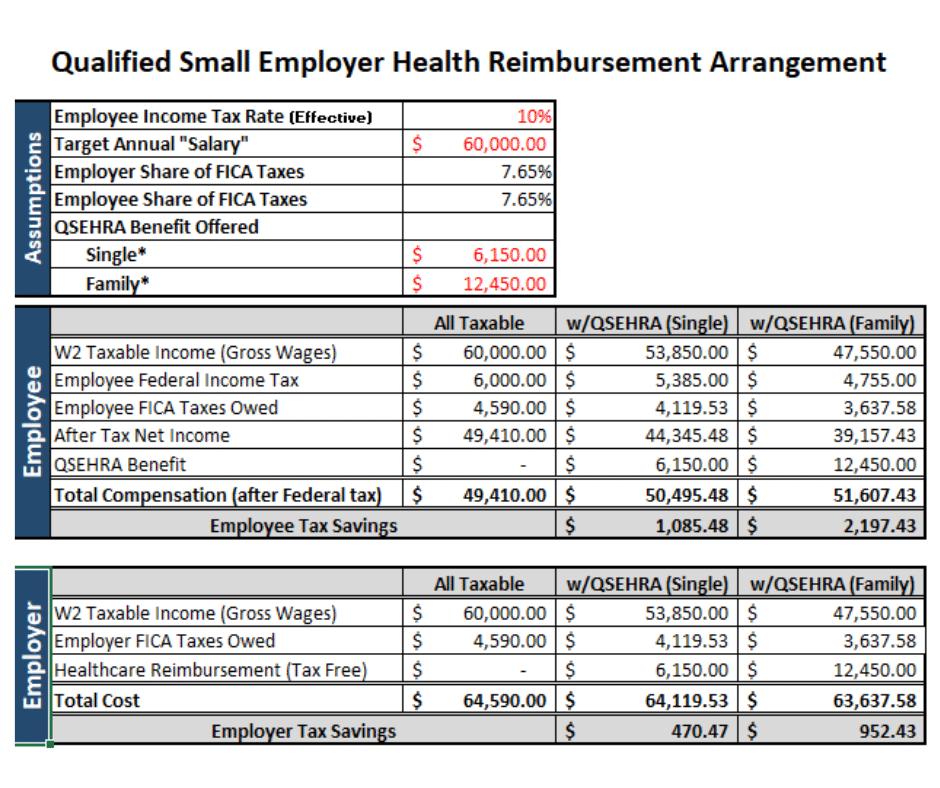

Assuming a 10% tax rate and a single plan reimbursement of $5,150 in the year, an employee earning $40,000 with no QSEHRA would have a net income of $32,940. If you were to offer the same $40,000 but included in that QSEHRA, you would pay $34,850 in wages. Your employee would net $28,698.98 PLUS the $5,150 in reimbursement for a total compensation after federal tax of $33,848.98. The lower taxable wage also means tax savings for the employer (~$400 in this case). Below is a breakdown showing this example in more detail.

Conclusion

Both the QSEHRA and ICHRA offer flexible, easy to manage tax-advantaged health reimbursement options for household employers and employees. These are easy to set up, easy to manage, and offer benefits to both the employer and employee. Increase your attractiveness as a household employer with nanny health insurance benefits. We’re happy to answer any questions about tax advantaged health reimbursement plans. You may schedule a call with us here or call our office directly at 1-877-899-3004.